Financial Advisory Services

powered by

A Partnership Based on a Common Vision

Fellows is unique in that their advisory firm doesn’t just plan investments. They work with our members to plan for your whole life: your business and family, today and tomorrow, and a legacy that empowers the people, the business, and causes that matter. Every Fellows advisor shares a deeply personal desire to protect clients’ lifestyles and legacies.

- They are not just advisors, they’re advocates, taking a personal interest in your success and proactively providing guidance and the right tools for achieving what matters most to you.

- They’re personally involved to keep all of your advisors in step with where you are, how your plan works, and where it could work even better as your circumstances change.

- Your personal point of view is what matters. They learn how you define “feeling safe” and “well off”. A “good” retirement. A “meaningful” legacy. And they use their understanding of what matters to you —and their tools and expertise – to let you look ahead with satisfaction and sleep well today.

We partner with Fellows because they share the same "people first" vision.

Financial Advisory Services | Business Advisory Services | Advisors' Corner

Fellows' advisors are available to consult with all USSFCU members on a wide range of topics including financial planning, wealth management, retirement planning, and more. Give them a call, send them an email, or use the button below to schedule a video consultation.

Schedule Now >>

Call: 703.429.9833 | Email: [email protected]

{beginAccordion h1}

Overview of Financial Planning

Overview Of Financial Planning

What Is Financial Planning

Done right, financial planning is a process that helps you figure out where you are financially today, where you want to be in the future, and then helps you determine a suitable way to get there. With the Fellows Financial Group advisors, the process involves an initial in-depth review of a client’s current financial situation and then the creation of a blueprint on how to manage future goals and objectives.What is a Financial Planner or Advisor?

Financial advisors are professionals who possess detailed knowledge of a wide range of financial planning tools and products. In addition, Fellows advisors are experts in combining the right tools and products with the right growth and protection strategy for meeting your specific needs and dreams for the future.What should I look for in a Financial Advisor?

A good financial planner must be a good fit for you. That’s why you should look for an advisor who will offer you a no-obligation “Get Acquainted” meeting via phone or in person. A financial planner should be your advocate, prioritizing the best interests of the client, on the products offered for sale. Fellows feels that being truly independent is the best way to give clients objective and deeply personal advice. As independent advisors we do not have limitations or requirements to use any specific investment product or solution; this allows us to create customized financial plans seeking to provide income, growth and “what if” protections for our clients.How Can A Financial Advisor Help Me?

Anyone of any age looking for financial independence can benefit from working with a good financial advisor. Fellows also provides corporations and organizations financial education programs for employees or members.Fellows serves clients at all income levels and from all walks of life—whether the need is an answer to one quick question or ongoing financial assessment, management, and direction. Each individual’s situation is unique.

Someone just starting may need a detailed, long-term plan of action while someone else already on the road to pursuing their goals may simply need a new strategy, professional insight, fine-tuning, or a second opinion of an existing plan.

Goals can be short, intermediate, or long-term. Reducing current income tax liabilities, for example, is a short-term goal. Funding a child’s education is an intermediate goal. Enjoying a secure financial retirement is a more long-term goal. By focusing on cash flow, investments, taxes, pensions, retirement plans, estate planning, insurance issues, savings opportunities, and other general financial matters, Fellows advisors can design a customized financial plan for you.

How Is Fellows Different?

What’s Different About Fellows Advisors?

We have all the knowledge and resources of the nation’s top firms, but with the warm family feel of a local financial advisory firm. As independent advisors, we are free to explore all options to make sure our clients get the best treatment available. We are advocates for our clients, their families, and their businesses. Rather than the “set it and forget it” approach to financial planning, we proactively help our clients pursue their goals, adapting their plan as circumstances evolve.What Are The Benefits Of

Financial Planning?

How Does Financial Planning Make A Difference?

Financial planning provides direction and aligns financial decision-making with your priorities and specific goals in each stage of your life. Planning allows you to understand how each financial decision you make affects other areas of your finances. For example, buying a particular investment product might help you save adequately to finance your child’s higher education or it may provide enough for a comfortable retirement. You can also adapt more easily to life changes and feel more confident that your goals are on track and within your comfort zone.Is Financial Planning Just For The “Already Wealthy”?

No. Fellows advisors have no income or investment account minimums. We value all of our clients and love to help anyone who is looking to start a path toward financial independence. No matter what you have now, it is always a good time to start planning for your future.My Spouse And I Need Help And Guidance Getting Started Building For Our Financial Future. Will Fellows Accept Us As Clients?

Absolutely. Any of our advisors will be happy to talk with you about your situation. Fellows advisors have no minimum income levels or net worth requirements. We realize that everyone has financial questions. We are proud to work with people from all income levels and all walks of life.I Already Have Substantial Assets And Am Doing Quite Well Financially-I Think. Can You Help Me?

Yes. Fellows advisors offer many services for those people who need more sophisticated financial planning or advice. If you’re interested in a professional review or a second opinion, we can provide that too.How Can I Plan For Tomorrow When I Can Hardly Pay For Today?

Start with a budget. Determine what you spend each month and where you spend it. There are fixed expenses like rent, loan repayments, etc. every month. The variable items such as food, clothing and entertainment are often what get away from us. Use your discretion to contain these variable expenses to start saving.How Much Should I Be Saving?

It is hard to apply a rule of thumb toward savings because it varies with age and income level. Ten percent is a good start. If you find that is too high, don’t let that deter you. Start by putting a little aside each month and then slowly increase it.How Does Fellows Work With Clients?

What Is The Fellows Investment Philosophy?

As financial advisors and investment consultants, we believe in the following fundamental principles to design an investment portfolio and make specific recommendations for each client. The purpose of an investment portfolio is to fund current and/or future financial objectives. The design of the portfolio must take into account the client’s financial objectives, tolerance for risk, needs for current income or liquidity, and special considerations such as income and estate taxes. The appropriate allocation of investment assets for your goals and risk tolerance is the most important component in developing an investment portfolio.We believe that a diversified, well-balanced portfolio, combined with long-term buy-and-hold strategies, affordability and patience, increases the likelihood that one will achieve his or her long-term financial objectives.

Why Is There An Evaluation Of My Insurance Needs?

Investments take care of your predictable needs. Insurance is critical for taking care of the “what ifs” that can happen at any time. This is why evaluating your insurance needs is part of personal financial planning and ideally should be addressed before addressing investments.What About Taxes?

Financial plans must be tax efficient. The financial plan should help you in minimizing your tax liability while also maximizing your after-tax returns from your investments.Do Fellows Advisors Provide More Than Comprehensive Financial Planning?

Yes. Although comprehensive planning yields the greatest benefits, Fellows also tailors services to clients’ specific needs. We can, for instance, address single issues like cash management and budgeting, investment analysis, college education funding or whatever is critical to you right now.What Is A Time Horizon?

“Time horizon” refers to the amount of time a person has to save for a particular event. For example, the time horizon for a college savings account might be 10 years for the parents of an eight-year-old child, but 15 years for the parents of a three-year-old. Likewise, the time horizon for a 30-year old saving for retirement might be 35 years, whereas it might be 15 years for a 60-year old who started saving late in life.Can Fellows Help With More

Than Planning?

If I Use Fellows To Develop A Financial Plan, Am I Obligated To Purchase The Recommended Products?

Absolutely not! We offer recommendations to address your needs and objectives, but you are under no obligation to purchase anything.How Do Fellows Advisors Select Investments?

Before recommending any investment, a Fellows advisor considers current economic conditions, the outlook for a particular asset class or type of security, and how the investment fits each client’s goals, objectives and risk tolerance. Because we hold ourselves to a fiduciary standard for our clients, we strive to obtain the most appropriate investment vehicles while being very conscious of total expenses and risk exposure.What If I Want To Buy Investment Or Insurance Products? How Do I Do That?

Fellows advisors can help you. We believe in helping you create and execute a complete plan, and often that involves insurance. We look at the full picture and help you decide what types of personal and/or business insurance are most appropriate for your financial needs and peace of mind.I’m In Charge Of The Retirement Plans And Employee Benefits At My Company And Would Like To Get More Employees To Participate. How Can You Help Us?

Education is key to increasing employee participation and appreciation. Fellows advisors can tailor a program for a company’s employees to help them understand the benefits of various programs.How Do Fellows Advisors Charge For Financial Advice?

If you are simply in the market for a specific financial product, we will gladly help educate you on a suitable fit for your needs, and facilitate the purchase for you. In these cases, we do not charge a fee because we receive compensation from the company offering the product. If you are looking for an all-encompassing financial plan, we will do an initial discovery meeting, then come back to you with a proposal. Depending on the effort required, we will be transparent about the fee for our services right up front.Can Fellows Help With More

Than Planning?

Once My Financial Plan Or Project Is Finished, Will Our Relationship End?

No. When we say, “it’s personal,” we mean it. We know that good financial planning is a process, not an event. Just as someone thinks of an eye doctor as an ongoing provider and has regular checkups to maintain good vision, good fiscal health requires periodic reviews of your finances by a qualified financial advisor. Your Fellows advisor will continue to keep you updated on your financial plan as much or as little as you like – from periodic reviews to day-to-day consultation. We also offer technology that allows you to check on your portfolio at any time.What If I Don’t Achieve My Goals?

Financial planning is a commonsense approach to managing your finances so you can work towards your unique life goals. It is a lifelong process. Remember that events beyond your control such as inflation or changes in the stock market or interest rates will affect your financial planning results. But with the right plan, you can put protections in place that help you weather both predictable and unpredictable risks.How Often Should I Update The Plan?

It is good to review the plan at least annually, or more often when there is a lifestyle change such as marriage, birth, death, or divorce. Any change in financial position should be evaluated as well. Most people have an annual update that reviews how the plan is being implemented. The review also considers realigning the plan as goals and circumstances evolve.Life Plans

STEP 1

Creating Your Life Plan

Once they’ve had that deeper conversation with you, they begin to plan: how to optimize income, focus investments on specific goals and minimize taxes. They look at how tools like business succession planning, estate planning, and insurance figure in. Then they widen the focus to see the whole picture — from potential risks and opportunities to strategies and safeguards. So instead of pouring everything into investments, taking tax hits and sacrificing a good life today for the hope of eventually retiring, you have a plan that’s focused on moving toward specific goals and enjoying life along the way.

WEALTHCARE PROCESSWEALTHCARE PROCESS

Uniquely Accurate Projections Reflect Your Personal Priorities

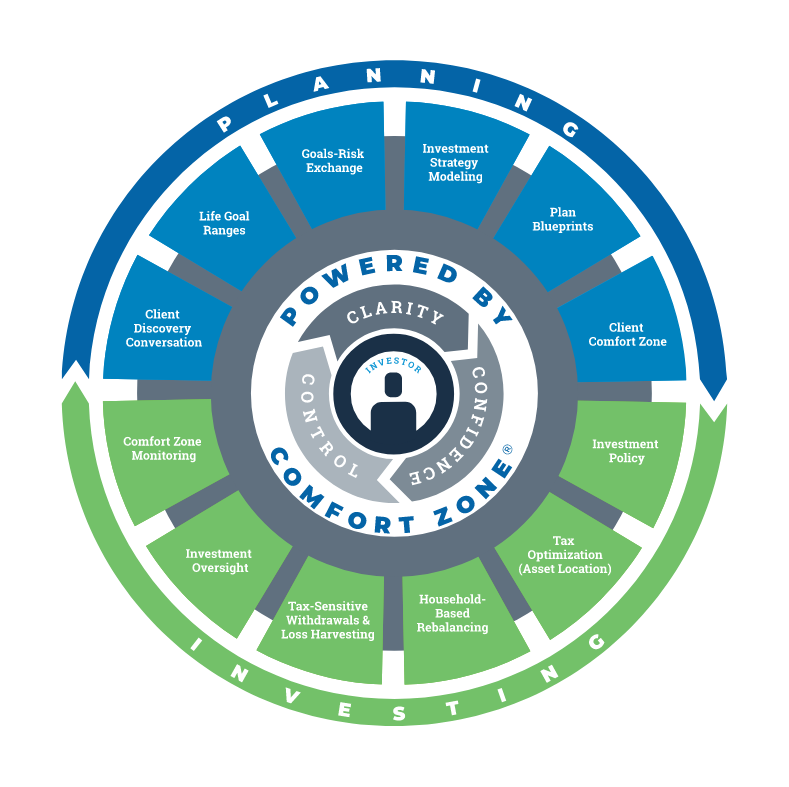

As a Wealthcare firm, Fellows Financial Group uses Wealthcare’s patented process for creating a custom plan that integrates comprehensive planning with targeted investing.

They base your life plan on your actual investments, milestones, goals and the personal legacy you want to leave. It’s more than financial planning, retirement planning, tax planning or estate planning: it’s all of that and it’s all those components talking to each other to amplify your wealth and protect it.

STEP 2

Putting Your Plan Into Action

They surround you with professionals who are experts with specific aspects of your life plan. If you already have a trusted CPA and attorney, They will make them part of our team and work together to build and execute your plan. If you don’t have a great CPA and attorney, we do —along with experts in insurance, estate planning, and business operations.

Once they assemble your team members, they don’t step away. They are there in meetings with you, working proactively for you—gathering information, building strategy, and collaborating side by side with you and your team to put the right plan into action and drive momentum.

From strategy and execution to paperwork, tracking, investment management, and other action items, your Fellows advisor does the groundwork to make it simple to follow your plan from now … to the future.

NEXT STEPSTEP 3

Updating Your Plan As Life Changes

Whenever there’s a shift in your business or personal life —or the economic climate—your advisor will work with you to adapt your Life Plan. They can scale up protections, realign investments, redefine your business exit strategy or strengthen estate planning to protect against new risks or seize new opportunities. Plus, they will know when you’ve saved enough to spend on milestones along the way: education, weddings, travel, a vacation home and the ultimate goals of enjoying a secure retirement and leaving a legacy that matters.

YOUR MAP TO THE FUTUREFamilies & Individuals

The Value of a Fellows Life Plan

Sit down with a Fellows advisor for a future-changing conversation about enjoying prosperity and peace of mind today — as you build your best tomorrow.

- If investments sour, where will your retirement “paycheck” come from?

- How can you protect assets from divorces or predators?

- Can you enjoy an abundant retirement if you’re struggling financially today?

Make Spending and Investment Decisions That Lock in Your Future Net Worth Today

Whether you’re a few years — or a few decades —from retirement, we create a Life Plan that starts from where you are and propels you toward a future you define. Investments, taxes, estate planning, retirement planning, insurance and income protections, legal guidance: your Fellows Life Plan integrates it all and aligns it all specifically with your unique situation, concerns, family, lifestyle and legacy.

We’ll map out your best “today” strategies for reducing taxes, maximizing your portfolio’s growth potential, and protecting yourself and your family against unexpected financial, legal, and health issues. So that when it’s time to retire, you’re all set to enjoy it.

You’ll save with a purpose – and part of that purpose

is to enjoy the life you’re living today

Saving and saving and saving isn’t a strategy. The point of saving is to fund specific “buckets” like protected retirement income, emergency reserves, even tuition or a wedding. We monitor your status continuously, so we can let you know when you’ve saved enough for a particular bucket and when it’s perfectly fine to buy a better home, start a new business or take that vacation.

SPEAK TO A FELLOWS ADVISORThey Run the Right Scenarios for you and Your Situation

So you’re ready for “what if…” and can:

- Keep the most value in your assets vs. watching assets melt away in tax losses

- Protect your family from “foreseeable risks,” such as sequence-of-returns risk

- Fill your emergency reserves

- Protect your income from the impact of potential health issues, market downturns or economic shifts

- Leave a meaningful legacy — without sowing family discord

You can stop worrying about trying to manage all the pieces and paperwork. You’ll have a clear path all the way through retirement. And because that plan is built on what matters most to you, it will be easy to put in the commitment to get from here to the future you’re envisioning.

So you won’t have to save and worry endlessly. You won’t have to let taxes erode your investments. And you won’t have to panic because today’s headlines make retirement seem impossible. Fellows can give you a Life Plan that helps you know everything is going to be all right.

The sooner you start, the more time your strategy has to produce results.

SPEAK WITH A FELLOWS ADVISORThe Fellows Team

|

Blake Fellows | President and CEOBlake, a trusted advisor with over 21 years of experience, is dedicated to assisting entrepreneurs, business owners, and individuals with personalized service and profound expertise. His mission centers on making Fellows the foremost firm for business succession, estate protection, and legacy perpetuation. Legacy perpetuation, the continuation of a person’s ultimate vision after their passing, is a core aspect of Blake’s philosophy. Beyond finance, team and community involvement empower Fellows to make a positive impact in every community they operate in. Blake’s hard work has positioned Fellows as a comprehensive planning, investment, and insurance resource for clients. He emphasizes treating everyone he works with the way he would want to be treated, underscoring the importance of empathy in serving clients. A Loudoun County native and James Madison University graduate, Blake feels blessed to serve on the board for Youth for Tomorrow, an organization founded by Joe Gibbs. Outside of work, Blake finds joy in coaching his children’s basketball and baseball teams and spending quality time with his family and wife, Kristen. Having witnessed Leesburg, Virginia’s transformation from a small town surrounded by dairy farms to a thriving extension of the nation’s capital, Blake’s clientele at Fellows Companies includes a diverse range of industries, such as farmers, government contractors, technology firms, construction, land developers, restaurants, law firms, and management consulting firms. Each client may have unique planning needs, but Blake’s experiences equip him to provide expert advice on business succession and protection, retirement, and estate strategies. Blake finds great pleasure in helping his team at Fellows grow and desires to cultivate a family of individuals who are passionate about their work, enjoy each other’s company, and can provide world-class service to all clients. |

|

Jeff Schalk | Chief Operating OfficerJeff Schalk serves as the Chief Operating Officer at Fellows Financial Group and co-founder of Fellows Insurance Group, a commercial and personal insurance agency. With a passion for helping people plan for their future and safeguard their family’s assets, Jeff aims to prevent anyone from facing unforeseen challenges. He believes that careful planning can avoid or mitigate many of life’s obstacles. Originally from Ohio, Jeff moved to the area in 1987 with his wife Stacy, and they raised their sons in Herndon, VA. He holds a bachelor’s degree from Miami University in Oxford, OH. Beyond his professional career, Jeff has actively contributed to the community. He has served as the past president of the Kingstream Community Council HOA and the Oakridge Homeowners Association. Additionally, Jeff has devoted countless hours to youth in the area through his involvement with the Boy Scouts of America and supporting neighborhood and high school competitive swimming. |

|

Michael Schimmel | Financial AdvisorMichael Schimmel is a Financial Advisor at Fellows Financial Group with extensive experience in financial services. Having worked for Global and National banks such as HSBC Bank and Wachovia, he has excelled in various roles, including Vice President and Cluster Manager, where he focused on new client growth, wealth management, mortgage, banking solutions, and community development strategies. Before joining Fellows, Michael was a Partner/Owner of McCallum Sauber, a wholesale floral delivery company, where he contributed to business growth and client satisfaction in the DC metro area. His emphasis on client development and engagement ensured substantial value for clients. Michael earned his BA in Political Science and Economics from Miami University in Oxford, Ohio, where he was actively involved in Phi Gamma Delta Fraternity and served on the Inter-Fraternity Council Board of directors and the Associated Student Government. His true passion lies in helping people. As a financial advisor, he assists clients in making sound financial decisions and implementation, allowing them to focus on the present rather than uncertainties. Beyond work, Michael volunteers and organizes community-building events as a Board member of Rotary in Northern Virginia. In his leisure time, he cherishes moments with his wife Meredith and three children, coaching his son’s baseball and basketball teams, and supporting his daughter’s dance recitals. He also finds joy in the outdoors. |

|

Kelly Keyser-Thompson | Business Development DirectorKelly Keyser-Thompson serves as the Business Development Director for Fellows Insurance Group, bringing with her over 25 years of valuable experience in the insurance industry. Her expertise makes her a valuable addition to our team of professionals. Kelly understands that insurance is essential for financial protection, and her first priority is comprehending each client’s unique circumstances to address their needs effectively. Previously, Kelly owned a successful independent insurance agency for 18 years, making her insights even more valuable to our Insurance Division. Originally from Bethesda, Maryland, Kelly has been a resident of Loudoun County since April 2000. Apart from her insurance career, she has a passion for figure skating, enjoys cycling, hiking, and any outdoor activities, and loves to travel. Kelly actively engages with the Dulles Regional and Loudoun Chamber of Commerce, having been a past member of the National Association of Women Business Owners (NAWBO) and the Business Women of Loudoun (BWOL). She also contributed as a former commercial insurance instructor at the Small Business Development Center. Kelly continues to support various local community organizations and non-profits, including the Ashburn Fire Department, Loudoun Hunger Relief, Loudoun Habitat for Humanity, and advocates for the annual Toys for Tots campaigns. Furthermore, she enthusiastically participates each year in Wreaths Across America at Arlington National Cemetery. |

|

Amanda Judd | Administrative AssistantAmanda Judd is an administrative assistant at Fellows. With a background in marketing and administration, she developed a strong passion for serving others through non-profit and ministry work after graduating from Virginia Commonwealth University in 2019. Amanda’s client support role at Fellows aligns perfectly with her heart for helping others. She recently got married in 2022 and welcomed her first child in June 2023. Amanda and her husband enjoy spending time outdoors, being with their growing families, and actively engaging in their church, Cornerstone Chapel. |

|

Beth Lobbin | Executive AssistantBeth Lobbin is an executive assistant at Fellows Financial Group. While this is her first role in financial planning, Beth brings valuable experience supporting executives in various professional services fields, including technology, consulting, and executive search. At Fellows, she provides support to our Founder and is enthusiastic about being part of the client service team. Beth’s passion lies in getting to know and providing excellent care to our clients. Originally from Michigan, Beth earned her bachelor’s degree in animal science from Michigan State University. She currently resides in Leesburg with her husband, two daughters, and cat named Willis. Outside of work, Beth enjoys cooking, watching her daughters dance, and actively serving at her church. |

{endAccordion}

As an independent firm, Fellows Financial Group advisors are not confined in the reach of their abilities and can explore all options to make sure clients get the best treatment available.

Part of their adherence to offering clients comprehensive services and products sometimes involves engagement with outside service providers. These relationships are constantly monitored and evaluated to ensure their value-adds to the client experience. While they partner with many corporations, a few stand out as primary providers and are listed below.

If you’re just beginning your search for a financial adviser, you may need some help forming a clear understanding of what a financial advisor is and what they can do for you. This article may offer some insight: Understanding Financial Advisors >>

For more detailed information on Fellows Financial Group, visit their website at www.fellowsfg.com.

Additionally, information on Fellows Financial Group services, fees, and credentials is available for review on the website of the U.S. Securities and Exchange Commission. You can also find certification, license, and employment history for Fellows Financial Group advisors using FINRA’s BrokerCheck.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck

Fellows Financial Group is registered through Arkadios Capital, a SIPC and FINRA member firm. Arkadios Capital and Fellows Financial Group are not affiliated and do not share common ownership. Securities offered through Arkadios Capital, Member FINRA/SIPC, advisory services offered through Wealth Care Advisory Partners.

Personal and Commercial insurance services are offered through Fellows Insurance Group LLC. Fellows Insurance Group LLC is a separate entity from Fellows Financial Group LLC, and Wealthcare Advisory Partners. Fellows Financial Group LLC, Fellows Insurance Group LLC and Wealthcare Advisory Partners do not offer tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Fellows Financial Group LLC, Arkadios Capital, and Wealthcare Advisory Partners are third-party partnerships and are not affiliated with United States Senate Federal Credit Union and USSFCU Best Life.

The Fellows Financial Group investment products are not insured United States Senate Federal Credit Union deposits and are not NCUA insured. These products are not obligations of the United States Senate Federal Credit Union and are not endorsed, recommended, or guaranteed by the United States Senate Federal Credit Union or any government agency. The investment value may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible. United States Senate Federal Credit Union is not a registered broker. All investing involves risk, including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.