Experian Credit - FICO Score

Access your FICO® Score for free in Online and Mobile Banking

USSFCU is proud to provide members with access to their Experian FICO Score along with key score factors and ingredients. Additionally, understand how your financial choices will affect your credit scores with an easy-to-use FICO® Credit Score Simulator. Whether you are paying off debt, opening a new credit card or even taking out a mortgage, you will be able to easily predict how different financial decisions will impact your FICO® Score.

Experian Dashboard |

Experian Education Center |

|

Get a snapshot of your credit score and a wealth of information that gives you great insight into your credit makeup.

|

This incredible resource is here to help you get a better understanding about how credit and credit scores work and impact your life.

|

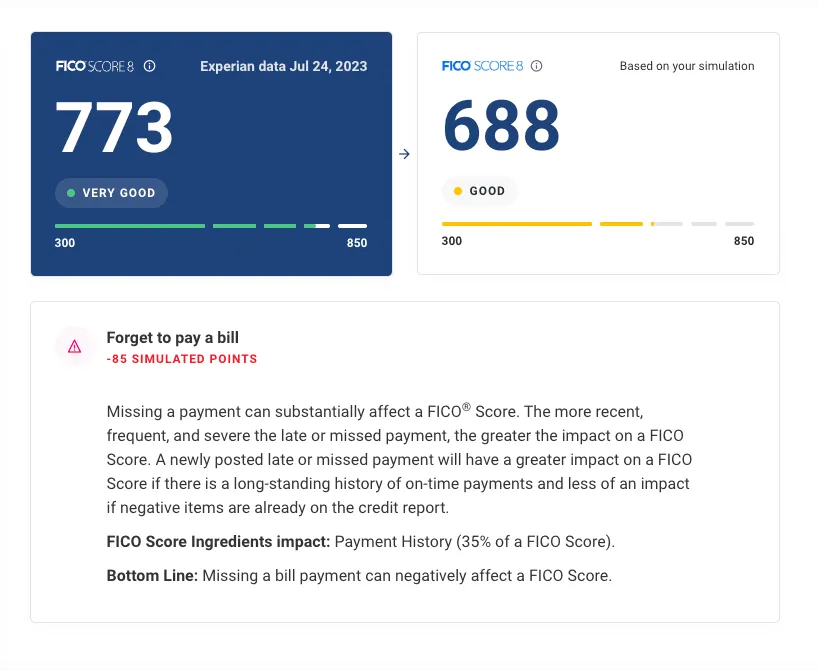

Use our FICO® Score Simulator

See real-time credit scenarios like applying for a mortgage, getting a new credit card or even filing for bankruptcy, without impacting your score. Its a roadmap to your credit and financial future.*

Access your FICO® Score through myUSSFCU online & mobile banking.

GET STARTED

Accessing Experian Credit and your FICO® Score through this platform will not impact your credit score.

You may need to disable pop-up blocking in your browser to access this tool. Instructions on how to do this can be found at the bottom of this page.

What is a FICO® Score?

What is a FICO® Score?

A FICO® Score is a key metric that lenders use to determine whether to approve or decline requests for credit. It is also a factor in interest rate decision making. A high FICO® Score could save you thousands of dollars in interest, while a low FICO® Score could result in high-interest rates or being declined for a loan, utilities, housing, and more.

This is a free service provided to USSFCU members.

To use the Experian Credit tool, you may need to disable pop-up blocking in your browser. Here are some simple Instructions on how to do this:

{beginAccordion}

Safari:

Mac:

-

Open Safari and click on Safari in the menu bar.

-

Select Settings (or Preferences).

-

Go to the Websites tab.

-

Click on Pop-up Windows on the left sidebar.

-

Select Block from the drop-down menu next to "When visiting other websites

iPhone/iPad:

-

Open the Settings app.

-

Scroll down and tap Safari.

- Toggle Block Pop-ups to turn it on or off.

Google Chrome:

-

Open Chrome: Launch the Google Chrome browser on your computer.

-

Access Settings: Click the three dots (More) in the top right corner, then select "Settings".

-

Privacy and Security: In the left-hand menu, click on "Privacy and security".

-

Site settings: Click on "Site settings".

-

Pop-ups and redirects: Scroll down to find "Pop-ups and redirects".

-

Choose your setting:

-

To block all pop-ups, select "Don't allow sites to send pop-ups or use redirects".

-

To allow pop-ups, select "Sites can send pop-ups and use redirects".

-

You can also customize settings for specific websites by adding them to the "Allowed" or "Blocked" lists.

-

Microsoft Edge:

-

Open Edge and go to Settings: Click the three-dot "Settings and more" menu in the top right corner, then select "Settings".

-

Navigate to Cookies and site permissions: In the Settings menu, click on "Cookies and site permissions".

-

Find Pop-ups and redirects: Under "All permissions," locate and click on "Pop-ups and redirects".

-

Toggle the Block setting: To disable pop-ups, ensure the "Block (recommended)" toggle is turned ON. To allow pop-ups, toggle it OFF.

-

Customize with site exclusions (optional): If you want to allow or block pop-ups from specific sites, you can manage this under the "Allow" or "Block" sections by adding website addresses.

{endAccordion}

If you encounter any personal credit information you deem as incorrect in the Experian Credit platform,

*About the FICO® Score Simulator

The simulator and simulated score are provided for informational purposes only and is intended to approximate the impact of various scenarios on your FICO® Score - assuming all other factors stay the same. Using this tool, you can get a better understanding of how various positive and negative actions you can take could affect your FICO Score.

Your actual score, and the impact of any action taken, results from a complex interaction of FICO's scoring methodologies and the information on your credit report, some of which changes daily. Also, please note the results of simulating different scenarios are not necessarily cumulative. In other words, simulating two different scenarios, each of which individually could raise your FICO Score by 20 points, will probably not collectively raise your FICO Score by 40 points. Information on your authorized user accounts are not considered in the FICO Score simulations.

FICO, the FICO Logo and the FICO product and service names referenced herein are trademarks or registered trademarks of Fair Isaac Corporation in the United States and in other countries. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian. Other product or company names mentioned herein are the property of their respective owners.