A New Way to Think About Cash

By: Fidelity Viewpoints v

Published: June 14, 2022

Key takeaways

- If you think of your investments in terms of years of your budget rather than dollars or percentages, you may develop a deeper understanding of—and appreciation for—how diversification can help you ride out downturns.

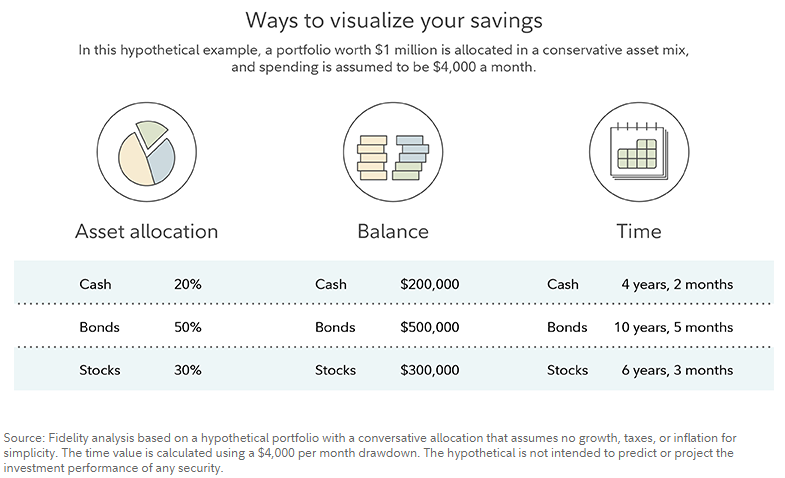

- To look at your holdings as time buckets, you first need to map out your portfolio allocation and assess your spending needs per year.

- Over time, as you spend cash, you sell stocks or bonds to replenish the cash bucket, always keeping a steady cushion in there to hedge against market conditions.

The old saying is that time is money, but money can also be time if you look at it a different way. Retired investors living off withdrawals might want to think of their portfolios in terms of how they support their spending needs over the next year and 30 years from now, which can create a compelling linkage between investments and their spending purpose.

If you think of your investments in terms of years of your budget rather than dollars or percentages, you may develop a deeper understanding of—and appreciation for—how diversification can help you ride out downturns. And if you can do that, you might be able to keep yourself from holding more cash than you need for your retirement plan, giving you a better chance of success for the long term.

"For a lot of people cash is comfort, and it helps them sleep at night, but if they aren't keeping up with inflation then they are trading one type of risk for another type of risk—investment risk for longevity risk," says Andy Reed, PhD, Fidelity's vice president for behavioral economics. "People are rightly concerned about market volatility, but no matter how much money people have in the bank, they also greatly fear running out of money before they die or not leaving the legacy they had planned."

Allocating your portfolio to time-based buckets isn't new, but it's not quite as common as the percentage view most people associate with retirement planning. When people talk about the way the money in their accounts is allocated, they typically describe it as having, for example, a 70/30 mix, where the 70% might be what's invested in stocks and the 30% is in what's referred to generally as "fixed income," which could mean bonds, CDs, or Treasuries, along with cash, or cash equivalents.

Your portfolio statements will have actual dollar amounts, typically a list of fund names that can be a bit of alphabet soup. The amount that is in cash might not jump out at you, because it might be listed by the letters for the money market fund where the cash is held. Some firms may have different graphical views of your holdings elsewhere on the actual statement or your online account, where you can see a pie chart or graph with the investment categories.

Time buckets help you visualize your situation

"It's a mental accounting that allows people to separate market fluctuations from their income streams," says Scott Kuldell, senior vice president of research and innovation at Fidelity. "People get nervous when markets go down. So if you separate out cash mentally and know it can last you long enough for the tide to turn around, you feel better that you can ride it out."

Building time buckets

To look at your holdings as time buckets, you first need to map out your portfolio allocation and assess your spending needs per year. You can do that with any number of online tools, including those offered by Fidelity.

Two people who are the same age with the same amount of assets may have completely different needs, because how much cash you need depends, of course, on how much you typically spend.

The cash bucket, when expressed in terms of time—years and months of normal spending—can help insulate you from what else is going on in the market and help you to understand where next month's budget is coming from. The number of years and months will vary depending on your target asset mix (or TAM) and, of course, your spending level, but in many cases it can be enough to cover your spending needs for long enough to allow the market to recover from a severe dip. Your stock and fixed income buckets would provide money for the longer term, and you could think of them as money to be tapped after the cash bucket.

If you look at the market downturn in March 2020, for instance, it turned out to be a short-term event. The recession in 2008-2009 took much longer to run its course, but still a cash bucket of 4 years, as in the example above, would have been more than sufficient to wait it out.

"The way we determine how much cash to keep for each individual is based on the total picture. It's an outcome of their goals, risk tolerance, and asset management strategy rather than a target," says Kuldell.

Risk tolerance versus risk capacity

Choosing an asset allocation typically starts with the investor going through a series of exercises and questions to figure out their risk tolerance, which is often an expression of how people feel about losing money versus making money. So risk tolerance is about how you feel, not about the math.

On the other hand, risk capacity is more objective—it's how much risk your portfolio could withstand and still have the potential to provide you with the money you need for your lifetime.

For instance, if you have a fortune of $100 billion, you are not worried about your daily food budget, and you could choose just about any investments to match your personal risk tolerance because your risk capacity is almost limitless. But for most people, choosing a target asset mix is a balancing act—they have to consider both risk tolerance and risk capacity.

"If a conservative person comes in and says, 'I don't want to risk it, I need to batten down the hatches,' then a financial professional might take them through risk capacity illustrations that show it's likely the plan will fail during their lifetime, because they aren't investing aggressively enough," says Michael Caplan, vice president of investment management research and development at Fidelity.

"But then we also see people who come in and say: 'Who needs bonds and cash? It's a waste of money to put stuff over there.' Then a financial professional might show them, in short-term downturns, that they can eat into their capital and they might also have a premature failure in their plan."

One of the most dominant feelings people have about their investments might be loss aversion—if they have money, they don't want to lose it. One way of understanding this feeling and combatting it in your investment strategy is to look at both how much you could lose if you are being too risky, and how much you could lose if you are too conservative.

"What's the scarier loss? Is it the temporary paper loss to your bottom line because of market exposure, or a total loss to zero because you use it up? If you really think about it, the second may be a lot scarier than the first," says Reed.

Refilling cash buckets over time

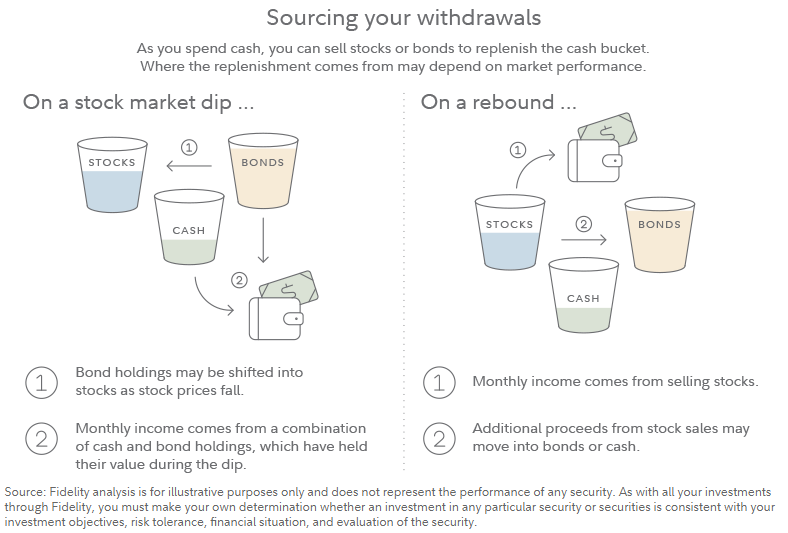

Another way to think about cash buckets is to visualize how they shift over time with market conditions and as your spending changes. The time buckets are not meant to be static, and they don't need to empty all the way to the bottom before being replenished.

Once you've determined an appropriate target asset mix and rebalance your portfolio regularly to maintain it, you could think of that process as a set of pipes between the buckets, with each bucket holding a different asset class, and the pipes moving money back and forth to keep each bucket at an appropriate level. So as you spend cash, you sell stocks or bonds to replenish the cash bucket, always keeping a steady cushion in there to hedge against market conditions. The process of rebalancing to a target asset mix means that money may flow into or out of your cash bucket, depending on what's happening in the markets, to keep it at the level that you consider comfortable.

For instance, if the stock market goes down 10%, your portfolio overall may also go down, albeit somewhat less than that, because the cash is invested to remain steady and the bonds may go up. But that still means your cash bucket may end up representing a longer time horizon than you need. If the decline goes on for some time, you might replenish your cash bucket more from bonds, or spend down the cash bucket a little less than usual, so you could give your stock bucket more time to recover. You might also be using some of your excess cash to buy stocks, while the market is still low. When the market is up, you might do just the reverse.

This may sound complicated, and it can be, so if you don't relish the idea of keeping track of everything yourself, you may want to hire a professional to manage your portfolio and take care of all the rebalancing for you.

"Choosing, and rebalancing, a target asset mix means that you will generally be covering your living expenses with money taken from cash when stocks are down, but from stocks when stocks are up," says Matt Kenigsberg, vice president of investment and tax solutions at Fidelity Investments. "You can think of the allocation to cash in your target asset mix—that is, your cash bucket—as a buffer that covers your living expenses when the stock market is down. So given that you've already got a buffer set up inside of your investment portfolio, you should ask yourself: Do I really need to set up another one outside of my investment portfolio?"

There's an important thing to keep in mind for this process to work properly: Look at the real big picture. Investors may have holdings at several different financial institutions, but when filling out the questionnaires and figuring out the target asset mix for each of these, they may leave out the money they have at other places. Your financial plan needs to work holistically across all your accounts.

"Try to think of your target asset mix as encompassing all your investment needs," says Kenigsberg. "That way, you don't have to keep some extra bucket of cash on the side just to make yourself feel safer, throwing your asset allocation out of balance."

This article was originally written for and published on Fidelity.com on July 8, 2021.