How to Invest in CDs: 3 Strategies

By: Spencer Tierney - NerdWallet

Published: July 5, 2022

When choosing a certificate of deposit, you might ask yourself — or the internet — whether you’re getting the best rate. After all, once you have a CD, you lock in that rate for months or years.

You can’t predict exactly what CD rates will look like in the future, but you can use strategies to reduce the risk of missing out when higher rates appear. At the same time, you still get the guaranteed returns and federal insurance that CDs offer.

"Peace of mind is top of mind for investors that are using CDs," says Michael Kealy, education coach at the brokerage firm TD Ameritrade.

Here’s a look at three main ways to invest with CDs.

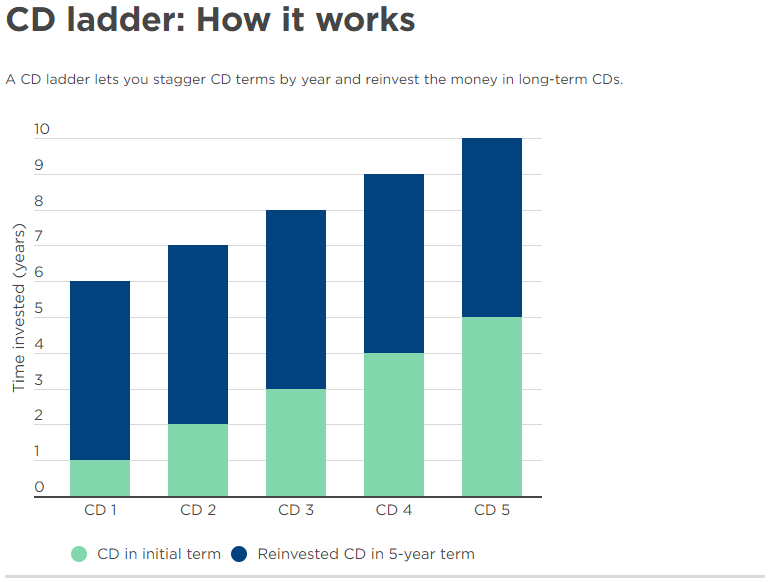

Strategy 1: CD ladder

A CD ladder consists of an investment divided up, usually in equal amounts, into multiple CDs of staggered term lengths. Each CD term is a rung of the ladder, and usually they’re equally spaced apart. When each CD matures, you reinvest in a long-term CD.

How it can work: Divvy up your investment, say $10,000, into five CDs:

- $2,000 in a one-year CD

- $2,000 in a two-year CD

- $2,000 in a three-year CD

- $2,000 in a four-year CD

- $2,000 in a five-year CD

When the one-year CD matures, take that $2,000 plus the interest it earned and reinvest it into a five-year CD. Ideally, you repeat this until you have a five-year CD maturing every year. But if you need funds one year, you can opt to withdraw whichever CD is maturing soon instead of reinvesting.

What a CD ladder is good for: A CD ladder lets you diversify across CD terms to take advantage of short-, midrange and long-term CDs. Typically the longer a CD term, the higher the rate. But if you stick with only long-term CDs, you lose access to that money for years.

A CD ladder provides a middle-of-the-road approach: regular access to some funds while earning long-term CD rates. Ideally, rates rise over time so you capture increasingly higher long-term rates, but if that doesn’t happen, a CD ladder still provides a solid mix of yields.

If you fret about where CD rates are headed, a CD ladder “take[s] the pressure off your shoulders,” says Kealy.

What to remember: A CD ladder works best if you don’t withdraw money. Make sure you have an emergency fund before investing in CDs.

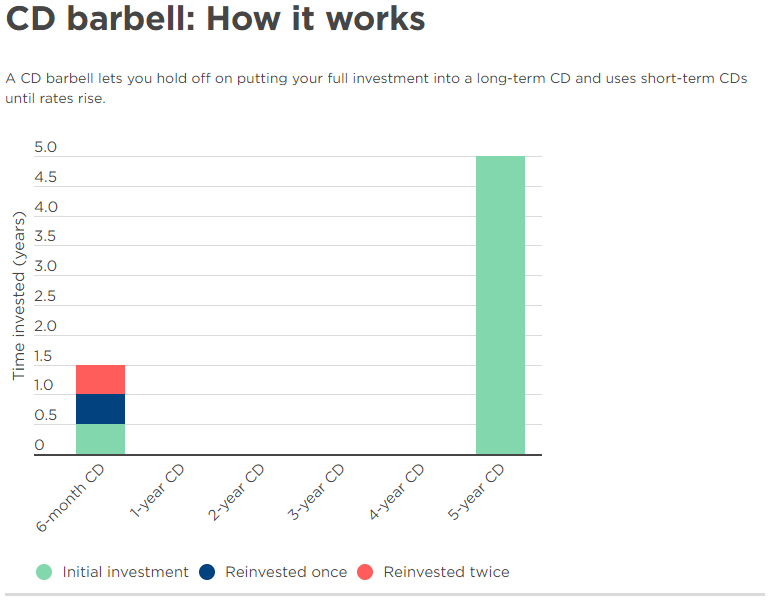

Strategy 2: CD barbell

A CD barbell involves splitting an investment into short- and long-term CDs — the two ends of the CD spectrum — but no midrange terms. When the short-term CDs mature, you either reinvest in short- or long-term CDs, depending on whether rates across the industry have risen.

How it can work: Divide your investment, say $10,000, into two CDs:

- $5,000 into a six-month CD

- $5,000 into a five-year CD

When the six-month CD matures, check on rates at various banks or, if applicable, your brokerage. If five-year rates have gone up, reinvest the money in a five-year CD. Or, if rates haven’t risen enough or at all, reinvest the $5,000 plus the interest it earned into another six-month CD. Half your funds might stay in short-term CDs awhile if rates stay flat or drop. Thanks to frequent maturities, though, you can choose to put that money elsewhere.

What a CD barbell is good for: When you’re waiting for rates to rise, a CD barbell gives you frequent access to some cash until you’re ready to lock in for a longer term. You also hedge bets by taking advantage of current long-term rates. Generally the overall return tends to be an average of short- and long-term CDs.

What to remember: A CD barbell is less diversified than a CD ladder, which makes it riskier in the sense that you might miss out on higher rates in the future. You can put more money on the short- or long-term end of a barbell, but this might make sense only if you understand — or speak to a financial advisor about — how current financial markets impact the direction of CD rates.

"It’s probably healthy to start off with the equally weighted [barbell] and see how that math works,” says Richard Carter, vice president of fixed income products and services at Fidelity.

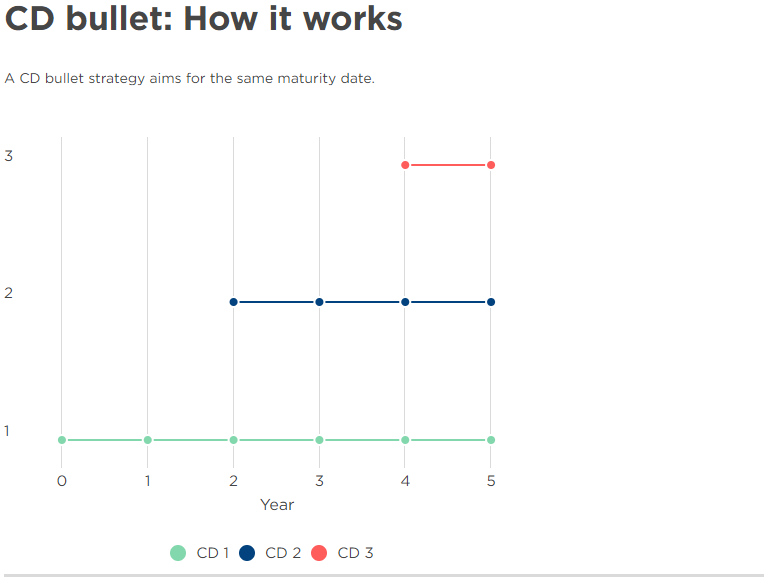

Strategy 3: CD bullet

A CD bullet strategy focuses on CDs that mature around the same date. If you open CDs over time, new terms will be shorter than the initial CD. Unlike with ladders or barbells, you don’t reinvest. If you only open one CD, it can technically be considered a CD bullet.

How it can work: Say you plan to buy a house in five years, so you put money in a five-year CD. Two years in, you can afford to put another chunk of money into a CD, and choose a new one that will mature around the same time as the initial CD. Four years in, you put more savings into another, much shorter CD. Once the fifth year ends, all CDs mature.

- $10,000 in a five-year CD

- $5,000 in a three-year CD in the second year

- $2,500 in a one-year CD in the fourth year

What a CD bullet strategy is good for: Usually you’ll use funds from CD bullets for a big expense, such as a wedding or down payment on a house. CDs tend to have higher rates than other bank accounts do, but most CDs don’t allow you to add money gradually. A CD bullet strategy can be a workaround: You can get shorter CDs over time, almost like a reverse CD ladder, to earn more interest on funds that you saved up since the initial CD.

What to remember: This strategy has more risk since you’re not reinvesting or diversifying across longer CD terms over time; your focus is on a future purchase. This risk refers to missing out on higher rates in the future, not losing money like you can when investing in stocks. In addition, many banks automatically renew CDs, so keep an eye on when your CDs mature to avoid missing your window of time to withdraw your money for free.

How to get started investing in CDs

Knowing the strategies can help you determine when and how many certificates of deposit will work for you. CDs are available at banks and credit unions as well as brokerages. (Brokered CDs work slightly differently than regular CDs.) If you need guidance on opening a CD, see this step-by-step guide.

Fidelity’s Carter says, in all of these CD strategies, the name of the game is to encourage you to think of your needs and to not sell or withdraw before maturity. If you do need to break the seal, know what early withdrawal penalties can cost you.

Check Out Our Share Certificate Rates

This article was originally written for and published on NerdWallet.com by Spencer Tienrney, on October 12, 2022.