How to Check Your Business Credit Score

By: Kelsey Sheehy - Nerd Wallet

Published: May 11, 2022

A top-tier business credit score can unlock preferred rates on financing and business insurance, and it can also open the door to potential partnerships and trade credit arrangements.

Unlike personal credit scores, which are standardized and available for free, each business credit bureau uses a different scoring system, and you often need to pay to view your report.

Your business credit score is also available to the public — meaning potential investors, partners and lenders can take stock of your company’s financial health, so it's important to monitor your report.

Checking your business credit score

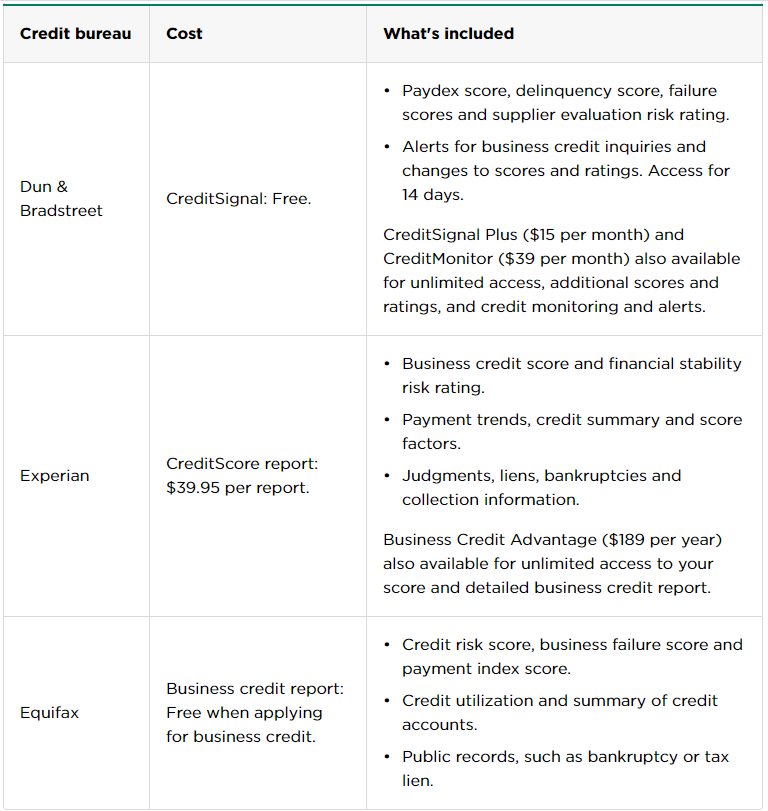

You can stay on top of your score, and check the financial health of other businesses, by pulling reports from the three main business credit bureaus: Dun & Bradstreet, Experian and Equifax.

Lenders may use different bureaus, so it's smart to check your business credit score with multiple agencies.

Dun & Bradstreet

Businesses don’t automatically get a credit score from Dun & Bradstreet. You first need a DUNS number — it’s free to apply but can take up to 30 days to receive. Once established, Dun & Bradstreet rates your business’s financial health and assigns a Paydex score, a delinquency score and a failure score, along with several other ratings and predictors.

Paydex evaluates payment performance and companies are scored between 0 and 100, with a higher score indicating better payment history. The delinquency score (101 to 670) assesses the likelihood a business will pay late (91-plus days) in the next 12 months. A higher score translates to a lower risk.

The failure score, previously referred to as the financial stress score, ranges from 1,001 to 1,875 and predicts whether a business will file bankruptcy or shut down without paying its debts within the next 12 months. A low failure score equals a high risk.

You can check your Paydex score (and three other ratings) for free with Dun & Bradstreet’s CreditSignal package, which includes alerts for score changes and business credit inquiries. Upgraded subscriptions offer access to more ratings and deeper analysis, plus additional alerts and monitoring, for $15 or $39 per month.

Experian

Experian’s CreditScore report includes your business credit score, financial stability risk rating, payments trends and account histories.

The business credit score (ranging from 1 to 100) looks at payment behavior, primarily on commercial accounts, including the number of delinquent accounts and the number of accounts with payment terms beyond net 30 days. A higher score equals a lower risk for delinquent payments.

According to its website, Experian's financial stability risk rating (1 to 5) "predicts the likelihood of payment default and/or bankruptcy within the next 12 months," using factors like commercial collection accounts, credit utilization, and business and industry risk factors. A low score indicates low risk for serious financial distress.

You can purchase your CreditScore report through Experian’s website for $39.95 per report or subscribe to Business Credit Advantage for $189 per year for unlimited access, plus alerts, monitoring and additional analysis. Experian does not offer a free business credit report.

Equifax

Equifax’s business credit report also includes multiple scores — credit risk, failure risk and payment index — to assess a business’s creditworthiness.

The credit risk score ranges from 101 to 992 and evaluates the likelihood of business failure or delinquent payments. A higher score equals lower risk. Payment index scores (1 to 100) evaluate payment history, with delinquent payments leading to a lower score. And the failure risk score (1,000 to 1,880) aims to predict the odds a business will shut down operations in the next 12 months. A lower score equals a higher risk of failure.

Owners can request their company’s report at no cost, but there are a few caveats. First, you can only get your own credit report if you’re applying for business credit, like a loan or credit card. Second, you have to contact an Equifax representative and provide proof of a business credit application.

Want to get insights on another business? You can contact Equifax to purchase a credit report for a competitor, partner or supplier. Unlike other business credit bureaus, Equifax does not publish pricing on its website.

Factors that go into your business credit score

Each credit bureau weighs different factors when calculating your business credit score, but most look at a combination of the following:

- Company size and age.

- Age of your oldest financial account.

- Available revolving credit limit.

- Established trade lines.

- Payment history to creditors and vendors.

Building your business credit score

A low business credit score — or no score at all — can make it difficult and more expensive to get business loans and payment agreements with suppliers. A business credit card can help you establish credit if you’re starting from scratch. Making on-time payments, establishing trade lines with suppliers and working with creditors that report to the main business credit bureaus are good places to start.

This article was originally wrriten for and published on NerdWallet.com on March 30, 2022, by Kelsey Sheehy.