myUSSFCU Online Banking

myUSSFCU Online Banking

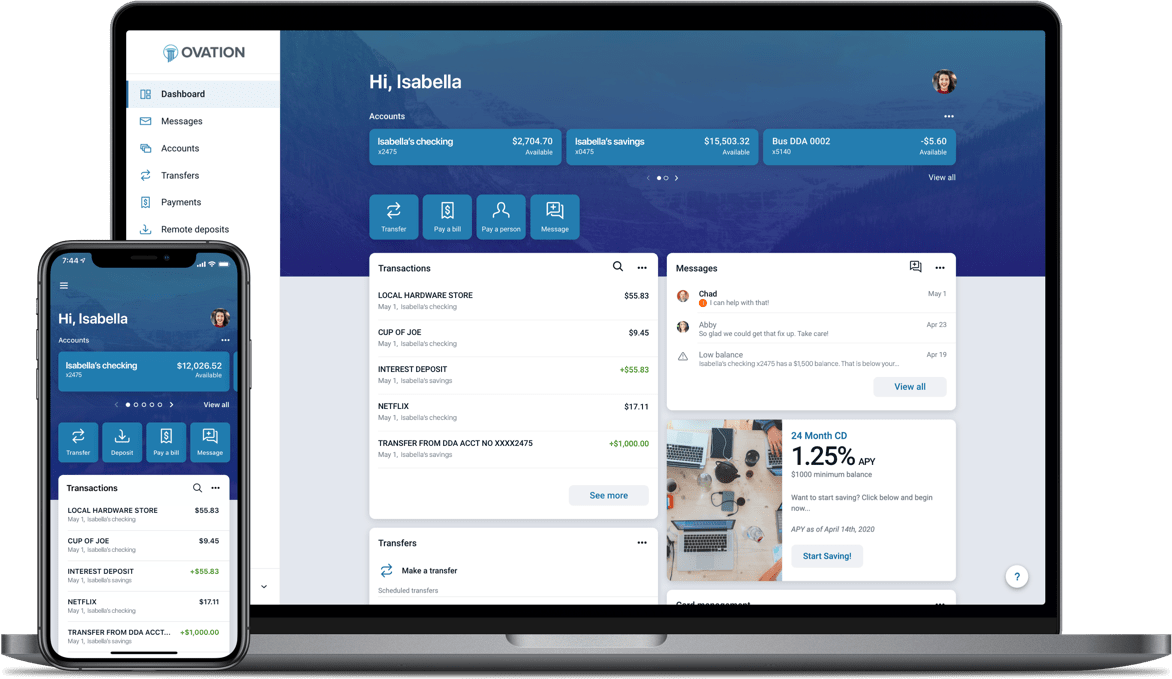

USSFCU has evolved our online banking experience in the pursuit of providing the best user experience (UX) possible. Member UX is our top priority—not only for every feature but for every touchpoint with another human.

Universal

Members have the power to view balances, make payments, add payees, transfer funds, manage cards and do even more whether online or on the go with the app.

Personal

The online banking experience is further personalized with transaction details, including contact information, locations, and the ability to add tags, notes and even images to individual transactions.

Informed

We are keeping members informed of the things they care about most. Set up alerts for high/low balances or transaction amounts. Members designate the thresholds, and they choose the alert delivery method.

Accessible

Need to speak with someone about your account? Let’s talk. Conversations are a quick, easy and streamlined way of getting answers to your questions.

Secure

In addition to more secure ways to access your account, we've implemented new technology that monitors activity and evaluates if a threat is present. It also blocks malicious attempts to access the platform without authorization.

Log in now and experience the difference!

my.ussfcu.org

Fraud Alert: Phone, Text & Email Scams

Be on high alert for any fraudulent activity and report it to us immediately.

We have had reports of fraudulent notifications being sent to members through phone calls, text messages, and emails, posing as account transaction alerts.

USSFCU will never send unsolicited emails, calls, or text you to ask for your:

- One-time verification code

- PIN number

- Username or password

- Personally identifiable information (account number, social security number, birth date, etc.)

Or any other identification details.

If you receive a message you feel might be fraudulent, do not provide any information, hang up, and independently call 800.374.2758 to speak to a team member at our Member Services Contact Center or log in to your account at my.ussfcu.org to verify transactions.

Please report any fraudulent activity immediately through email, secured messaging in online banking or by phone.

- Secure access to your USSFCU accounts*

- Pay bills online

- Review account statements

- Online Application

- Apply for loans, lines of credit and credit cards online

- Open new accounts like saving, checking, and money markets online

- Activate or block cards

- Transfer funds between USSFCU accounts and other banks

- Transfer funds person to person

- Bank to Bank Transfer - Make a USSFCU loan payment from another financial institution

- View account transactions

- Place stop payments

- Order checks

- Redeem Smart Rewards points

- Securely communicate with a USSFCU Member Services Representative using Conversations

- The ability to integrate and use financial management software such as Microsoft® Money or Intuit® QuickBooks

*from anywhere you have a secured and password-protected internet connection