That's Not Normal: Scam Messages That Scream Fraud

Published: February 21, 2025

Ever received a text or email that just didn’t seem right? Maybe it was a random bank alert, a surprise gift card, or an urgent message claiming your account is locked. If your first thought was, “That’s not normal,” then congratulations—you spotted a scam before it spotted you.

Scammers rely on urgency, fear, and confusion to make you react before thinking. The good news? Their tricks are predictable once you know what to look for. Below are some of the most common scam messages being sent today and how to avoid falling for them.

The Fake “Bank Alert” That’s Suspiciously Vague

A text from an unknown number pops up:

"Dear customer, your account has been locked due to suspicious activity. Click here to unlock: bank-security-fix.xyz."

Wouldn’t your actual bank use your name instead of calling you “Dear Customer”? Would they really use a random link with ".xyz" in it? Probably not.

Red Flags That Indicate a Scam

- A legitimate bank will always use your name. Generic greetings are a major red flag.

- The URL is not from your bank. Banks do not use random domains like ".xyz" or ".info."

- Banks never ask you to log in via a text link. If there’s an issue, they will tell you to log in through their app or official website.

What to Do: Ignore the text and check your bank account directly by logging in through their app or website.

The Fake “Congratulations!” Gift Card Scam

A text arrives unexpectedly:

"Your $100 CVS gift card is ready! Click here to claim your reward."

If you never signed up for anything, why would you be receiving a gift card?

Red Flags That Indicate a Scam

- The message does not include any sender details or context.

- The link is not from CVS or any recognizable domain.

- You did not sign up for any promotions, so why would you win?

What to Do: Delete the message and check your CVS account directly. If you were eligible for a reward, it would be listed there.

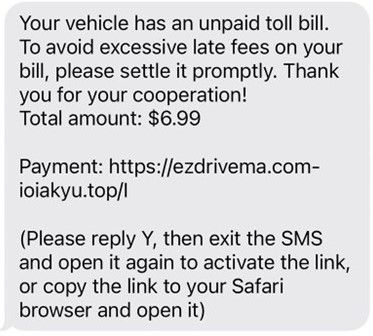

The Fake Toll Payment Scam

You receive a text that reads:

"Your vehicle has an unpaid toll balance of $6.99. Avoid penalties by paying now: ezpass-payfast.com."

This small charge seems believable, which is exactly what scammers are counting on.

Red Flags That Indicate a Scam

- The website URL does not belong to a real toll provider.

- No details are included about when or where the toll was incurred.

- The message urges immediate payment before verifying the charge.

What to Do: If you’re unsure, log into your actual toll provider’s website and check for unpaid balances. Never pay from a text link.

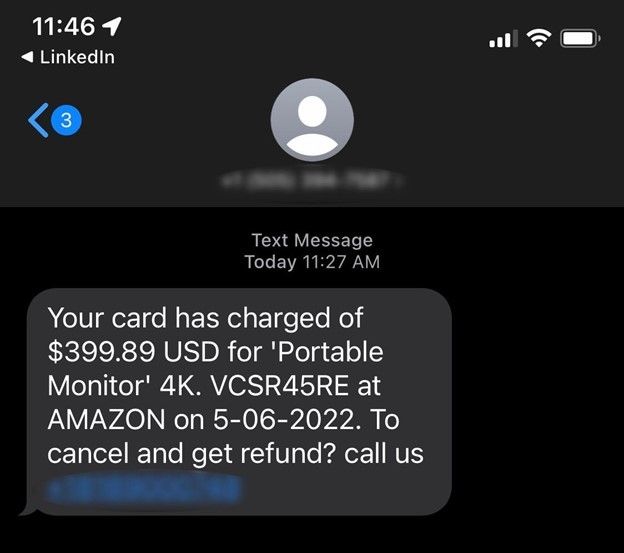

The Fake Amazon Purchase Alert

A message appears claiming you were charged $399.89 for a “Portable Monitor 4K” on Amazon. It says, "If this wasn’t you, call now for a refund."

Your first instinct may be to call immediately, but that is exactly what the scammer wants. The number does not belong to Amazon—it connects you to a scam call center where they will try to steal your login credentials or credit card details.

Red Flags That Indicate a Scam

- Amazon fraud alerts do not come from random phone numbers.

- The message directs you to call a number instead of logging into your account.

- The charge amount is oddly specific yet completely unfamiliar.

What to Do: Log into your Amazon account directly. If there is no suspicious charge, the message was a scam.

The Fake Payroll Deposit Scam

Just before payday, you receive an email from “Payroll Services” saying:

"Your direct deposit could not be processed due to incorrect banking details. Click here to update your information immediately."

If you are in a rush, you might click before realizing the email did not come from your employer, but from a scammer trying to reroute your paycheck.

Red Flags That Indicate a Scam

- Your employer would not send this type of request through a vague email.

- The “update your info” link leads to a non-company website.

- The email creates urgency, pressuring you to act immediately.

What to Do: Contact your HR or payroll department directly. If there is an issue, they will confirm it.

The Account Lockout Scam

You receive an email that says:

"Your Netflix account has been suspended due to a billing issue. Click here to restore access."

Would Netflix really cut off your access without multiple warnings? Probably not. Clicking the link will take you to a fake login page designed to steal your credentials.

Red Flags That Indicate a Scam

- The email address does not match Netflix’s official domain.

- The link immediately asks for sensitive login details.

- Netflix, or any legitimate service, will always give multiple warnings before suspending an account.

What to Do: Go to Netflix’s official website and check your account. If there is a real issue, you will see a notification there.

How to Stay Scam-Free

Scammers rely on urgency and deception to trick people into giving up personal information or sending money. The best way to stay safe is to recognize the warning signs and slow down before taking action.

Ways to Outsmart Scammers

- Pause before reacting—scammers create urgency to pressure you.

- Never click on unexpected links—go directly to the official website.

- Verify sender details—if something feels off, trust your instincts.

- Enable two-factor authentication on all accounts for additional security.

Article content is provided for informational purposes only.